2023 CITY OF MANASSAS MARKET REPORT

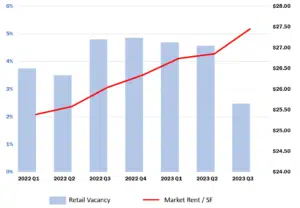

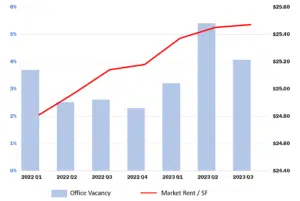

The Manassas real estate market continues to significantly outperform the region. Commercial vacancy rates dropped dramatically from 3.1% to 2.0% this past quarter. Demand from businesses that are growing in the community, and those that want to locate here, is creating an extremely tight leasing and sales environment. This has led to increases in rents and building values.

All of this runs counter to macro-economic news about interest rates, on-line retail, remote work, and the most anticipated recession in human history. Maybe we should knock on wood, cross our fingers and toes, avoid black cats and the number 13, or stay away from ladders and mirrors – but none of that has impacted one of the fastest growing communities in Virginia. Those of you that follow our market know this, but those of you who don’t should take note.

Amazingly (or regrettably depending on your viewpoint) when preparing this update, the Department of Economic Development was only able to identify four industrial or flex properties available for sale or lease in the entire City. The law of supply and demand is hard at work and asking rents are still climbing — although not as rapidly as over the last several years. Average commercial rents are now at an all-time high $21.29 per square foot. We have been advising our readers about the tight industrial market for quite some time but this scarcity is unprecedented.

In a City like ours that is constrained geographically, this should present opportunity for redevelopment — we are ready to assist developers looking to take advantage of this unprecedented low inventory who wish to build or expand within the City. The underlying metrics tell the story that many are familiar with: Manassas continues to be a highly desired place for businesses to invest in and succeed.

As noted in the introduction, flex warehouse space is harder to find in Manassas than affordable housing is in McLean. The vacancy rate is at an historically low .5% and asking rents are at an historical high of $15.29 per square foot.

Industrial vacancy hit a low of .8% at the close of Q3 although asking rents for this property type did decline from a peak price of $15.48 sf in Q1 to $14.29 on September 30. Currently only 1 flex and 3 industrial properties are available for sale or lease in the City limits.

Given the location and talent advantages Manassas offers, this property type is in highest demand and continues to be constrained by a lack of available space. Major manufacturers like Micron, Leidos, BAE, and Lockheed Martin in the Godwin Technology Corridor account for the bulk of the City’s industrial space while other industrial corridors house a variety of businesses in warehousing, construction, automotive, and other flex uses.