Q1 2024 CITY OF MANASSAS MARKET REPORT

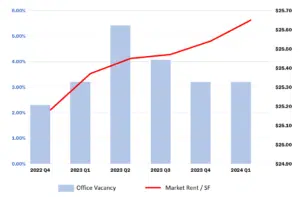

So far 2024 looks to be shaping up like years past with strong demand and low vacancy rates across all commercial real estate sectors in City of Manassas. The commercial sector has maintained its historically low 2% vacancy and all-time high rent price of $21.29 (7 cents higher than last quarter). Unlike the market rent price, which has had a sharp, consistent climb for 10 years straight, the market sales price has had a slower growth trajectory. The $217/sf sales price is a slight uptick from $215/sf in Q4 2023. This price is still $34 higher than the 10-year median, but $12 lower than the peak sales price of $229 in Q2 2022.

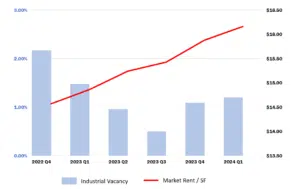

These high rent and low vacancy trends are consistent with industrial, retail, and office properties alike with the exception of a negligible increase in industrial vacancy from 1.1% in Q4 2023 to 1.2% in Q1 2024. These rates far outperform the regional average making demand from businesses for new or larger spaces hard to fill. As we’ve said in the past, low supply and high demand should present opportunity for new and redevelopment – we are ready to assist developers who wish to build or expand in Manassas. Our office is also primed to help businesses connect with brokers and prepare for growth needs within the City market. Learn more about our business development services on our website here.

As the industrial and flex real estate sectors continue near-zero vacancy rates for 12 straight months, the industry is seeing an 8% rental rate increase within a one-year span. The Q1 2024 market rent is $15.94/sf for industrial and $16.35/sf for flex. Meanwhile, vacancy dropped from .63% (Q4 2023) to .61% (Q1 2024) for flex and ticked up from 1.1% (Q4 2023) to 1.8% (Q1 2024) for industrial.

The time on market for industrial and flex space remains exceptionally low — 1.1 months for flex and 2.7 months for industrial. It’s literally a first-come, first-served market when a space opens up.